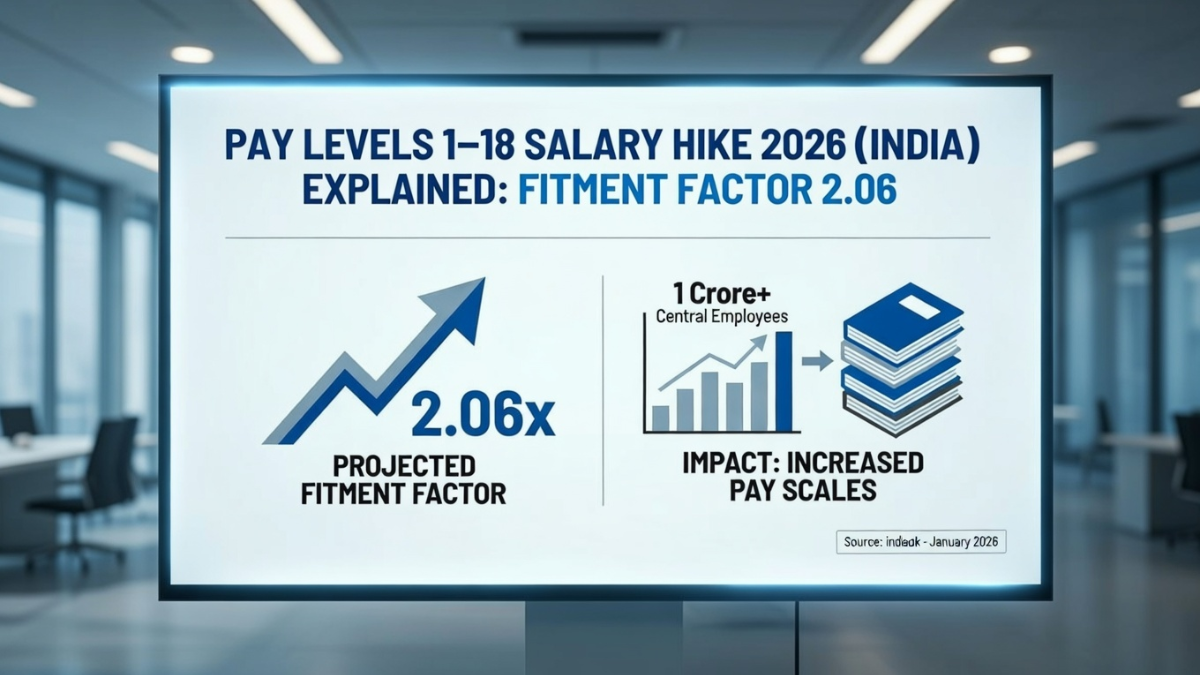

Central government employees across India are closely tracking developments around the proposed Pay Levels 1–18 salary hike in 2026, as discussions around a fitment factor of 2.06 gain momentum. With inflation pressures, rising housing costs, and growing demands from employee unions, the proposed revision is being seen as one of the most consequential pay updates in years.

If implemented, the change could reshape monthly take-home pay for more than one crore serving and retired central government employees, spanning entry-level staff to senior officers.

Why the 2026 Salary Hike Is in Focus

Government pay revisions are typically driven by cost-of-living changes and recommendations from pay review mechanisms. In 2026, attention has intensified because existing pay structures are increasingly viewed as inadequate against rising expenses.

The proposed hike reflects ongoing evaluations within the central administration under the Government of India, with employee groups pushing for a revision that better aligns salaries with current economic realities.

What Is the Fitment Factor and Why 2.06 Matters

The fitment factor is the multiplier used to revise basic pay across all pay levels. It determines how much an employee’s existing basic salary increases when a new pay structure is applied.

A fitment factor of 2.06 means the current basic pay would be multiplied by 2.06 to arrive at the revised basic pay. Even a small change in this number has a large impact because it applies uniformly across Pay Levels 1 to 18, affecting allowances, pensions, and retirement benefits linked to basic pay.

How Pay Levels 1–18 Are Structured

Pay Levels 1–18 cover the full spectrum of central government roles. Lower levels include clerical staff, assistants, and support roles, while higher levels include officers, senior administrators, and top-level officials.

Because the same fitment factor applies across all levels, the revision creates a cascading effect. Entry-level employees see a meaningful boost in monthly income, while senior officials experience substantial increases due to higher base salaries.

Expected Impact on Monthly Salaries

If the 2.06 fitment factor is approved, employees at lower pay levels could see a noticeable jump in their basic pay, translating into higher take-home salaries after allowances are recalculated. For higher pay levels, the absolute increase in rupee terms would be significantly larger.

Allowances such as Dearness Allowance, House Rent Allowance, and Transport Allowance are all linked to basic pay, meaning the salary hike extends beyond just the base amount.

What This Means for Pensioners

Retired central government employees are also watching the proposal closely. Pension calculations are directly tied to last drawn basic pay, so any revision under the new fitment factor would raise pension amounts as well.

For pensioners, this could mean improved monthly income stability, especially important for managing healthcare and living expenses in retirement.

How This Compares to Previous Pay Revisions

In earlier pay revisions, fitment factors played a decisive role in shaping employee satisfaction. Comparisons are already being drawn between the proposed 2.06 factor and previous revisions, with many employee unions arguing that the current proposal better reflects inflation and productivity growth.

The broader scope of Pay Levels 1–18 also ensures that the revision is comprehensive rather than targeted to specific cadres.

Who Benefits the Most From the Change

Employees at the lower end of the pay scale often feel the greatest relative impact, as even moderate increases significantly improve their standard of living. Middle-level employees benefit from both higher pay and improved allowance calculations.

Senior officials see the largest numerical increases, though the policy focus remains on ensuring fairness and balance across all levels.

Is the Salary Hike Confirmed Yet

As of now, the salary hike and the 2.06 fitment factor remain under discussion and evaluation. No final notification has been issued, and implementation timelines depend on approvals, budget considerations, and formal announcements.

However, the scale of discussion and the number of stakeholders involved indicate that a structured revision is actively being considered.

Why This Matters for the Indian Economy

A large-scale salary hike for central government employees has wider economic implications. Increased disposable income can boost consumption, while higher pension payouts improve financial security for retirees.

At the same time, the government must balance fiscal responsibility with employee welfare, making the final decision carefully calibrated.

What Central Employees Should Do Now

Employees are advised to stay updated through official communications and avoid relying on unverified claims. Understanding how the fitment factor works can help employees estimate potential changes to their pay and plan finances accordingly.

Any final decision will be communicated through official channels once approvals are completed.

Conclusion

The proposed Pay Levels 1–18 salary hike in 2026, driven by a fitment factor of 2.06, has the potential to significantly reshape earnings for over one crore central government employees and pensioners. While not yet finalised, the proposal reflects growing recognition of cost-of-living pressures and the need for updated compensation structures.

If approved, it would mark a major milestone in central government pay reform, delivering broad-based financial relief across the workforce.

Disclaimer: This article is for general information only and does not confirm final approval, figures, or implementation timelines of the proposed salary revision.