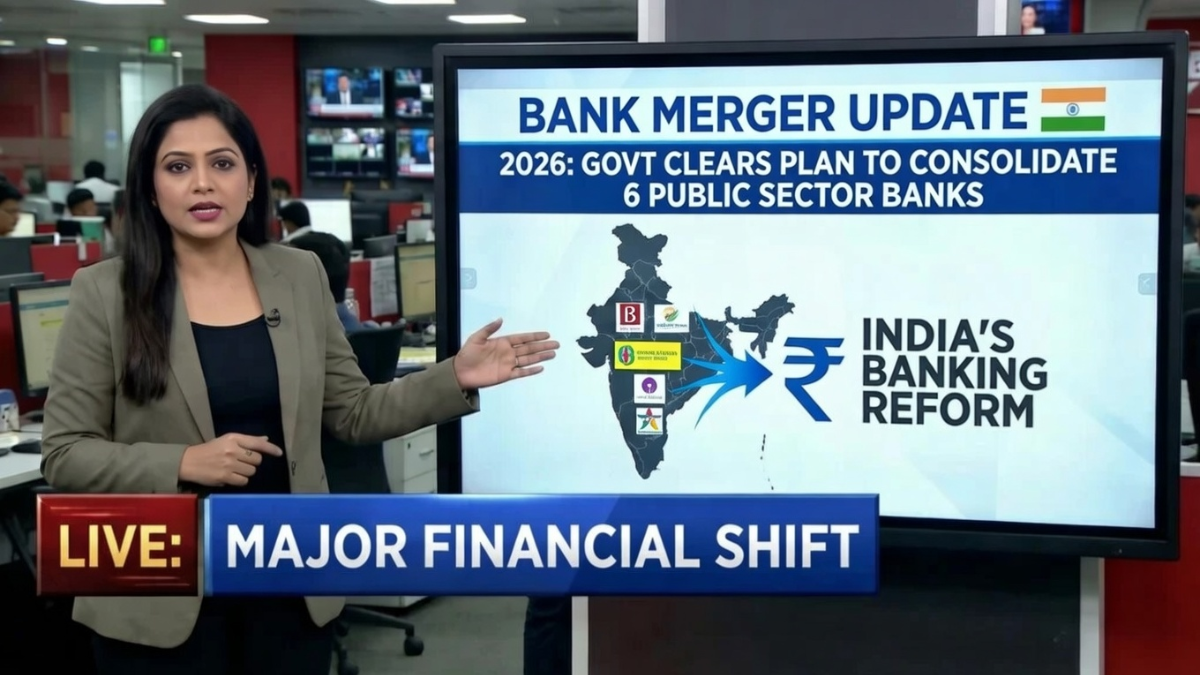

India’s banking sector is set for another major reshaping in 2026 as the government officially clears a consolidation plan involving six public sector banks. The move signals a renewed push toward creating stronger, more efficient state-owned banks that can support economic growth, improve profitability, and compete more effectively with private and global lenders.

While the plan does not immediately change how customers use their bank accounts, it represents a significant structural shift that will gradually affect branches, operations, employees, and the overall banking ecosystem.

Why the Government Is Moving Ahead With Bank Mergers in 2026

Public sector banks continue to play a critical role in India’s credit system, especially in lending to agriculture, MSMEs, and infrastructure projects. However, challenges such as rising operational costs, overlapping branch networks, and pressure on balance sheets have persisted.

The consolidation push reflects policy direction from the Government of India, which aims to build fewer but stronger banks with better capital strength, improved governance, and enhanced risk management.

What the 6-Bank Consolidation Plan Involves

Under the cleared plan, six public sector banks are proposed to be merged into a smaller number of larger entities. While final merger combinations and timelines are expected through official notifications, the objective is to reduce fragmentation within the PSU banking system.

By pooling resources, technology platforms, and branch networks, the merged banks are expected to achieve economies of scale and operate more efficiently.

How This Builds on Earlier Bank Mergers

India has already undergone multiple rounds of bank consolidation over the past decade, significantly reducing the number of public sector banks. Those earlier mergers laid the groundwork for the current move by streamlining operations and improving capital adequacy.

The 2026 plan builds on these experiences, with policymakers aiming to address gaps that remain after previous mergers, particularly around digital integration and customer service consistency.

What This Means for Bank Customers

For most customers, everyday banking is expected to continue without disruption. Existing savings accounts, fixed deposits, loans, and credit facilities will remain valid even after mergers are implemented.

Over time, customers may benefit from wider branch access, improved digital services, and a more uniform range of products across merged banks. Any changes to IFSC codes or branch names are typically communicated well in advance.

Impact on Bank Employees

Bank employees often face uncertainty during merger announcements. The government has indicated that the focus will be on redeployment, retraining, and natural attrition rather than sudden job cuts.

Past mergers have generally protected employee service conditions, and similar safeguards are expected during the 2026 consolidation process.

Why Fewer, Stronger Banks Are a Policy Priority

Larger banks with stronger balance sheets are better positioned to handle economic shocks, manage non-performing assets, and fund large-scale development projects. Consolidation also helps reduce duplication in operations and administrative costs.

From a regulatory standpoint, overseeing fewer but healthier banks simplifies supervision and strengthens financial stability.

Role of the Banking Regulator

The consolidation process will take place under the close supervision of the Reserve Bank of India. Regulatory oversight will focus on capital adequacy, asset quality, customer protection, and seamless integration of systems.

Phased implementation is expected to minimise service disruptions during the transition.

Challenges That Could Arise

Despite its benefits, bank consolidation is complex. Integrating IT systems, aligning corporate cultures, and ensuring smooth customer communication require careful execution.

Short-term challenges such as operational delays or customer confusion are possible if implementation is rushed, which is why a gradual rollout is likely.

What Customers Should Watch For in 2026

Customers should stay alert to official communications from their banks regarding any procedural changes. Updates related to branch consolidation, digital banking platforms, or service channels are usually announced in advance.

No immediate action is required unless specifically advised by the bank.

What This Means for India’s Banking Future

The approval of the 6-bank consolidation plan reinforces the government’s long-term vision of a streamlined and resilient public banking sector. As credit demand grows and financial services evolve, stronger public sector banks are seen as essential to sustaining economic momentum.

The 2026 merger update may not be the final phase of consolidation, but it marks another important milestone in India’s ongoing banking reforms.

Conclusion

The government’s decision to clear a plan to consolidate six public sector banks in 2026 highlights a continued commitment to banking sector reform. While customers and employees are unlikely to see immediate changes, the long-term impact is expected to be a more efficient, stable, and competitive PSU banking system.

As implementation details emerge, gradual adjustments rather than sudden disruption are expected, shaping the future of public sector banking in India.

Disclaimer: This article is for general information only and does not constitute financial, banking, or investment advice. Final merger structures, timelines, and implications will be confirmed through official government and bank notifications.